What is the Equifax Report?

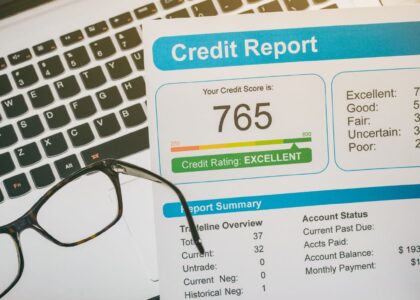

The Equifax report is a vital component of the credit repair process. It refers to a credit report provided by Equifax, one of the major credit bureaus operating in the United States. As a leading credit reporting agency, Equifax collects and maintains a vast repository of consumer credit information. This includes data related to credit accounts, payment history, public records, and other relevant financial details.

The Equifax report serves as a comprehensive snapshot of an individual’s creditworthiness and financial history. It plays a crucial role in various financial transactions, such as applying for loans, mortgages, credit cards, or rental agreements. Lenders and creditors often rely on the information contained in Equifax reports to assess an individual’s creditworthiness and make informed decisions regarding extending credit or determining interest rates.

Equifax, alongside Experian and TransUnion, is recognized as one of the three major credit bureaus in the United States. These bureaus serve as trusted intermediaries between creditors and consumers, providing accurate and up-to-date credit information.

By accessing the Equifax report, individuals can gain insights into their credit standing, identify any discrepancies or errors that may be impacting their credit scores, and take appropriate steps to address them. Regularly reviewing the Equifax report is essential for maintaining healthy credit and financial well-being.

In the following sections, we will explore how individuals can open an Equifax report, the purpose of Equifax as a credit bureau, whether Equifax is still a credit bureau, and the availability and cost of Equifax reports.

How to Open an Equifax Report

Obtaining your Equifax report is a straightforward process that can be completed through various channels. Equifax provides multiple options for individuals to access their credit report. Here’s a step-by-step guide on how to open an Equifax report:

- Online Access:

- Visit Equifax’s official website and navigate to the section dedicated to credit reports.

- Look for the option to request your Equifax report online.

- Provide the required information, including your personal details, social security number, and any additional authentication steps.

- Follow the prompts and review any terms or conditions associated with accessing your report.

- Upon successful verification, you will be able to view and download your Equifax report online.

- Phone Request:

- Contact Equifax’s customer service helpline, which is typically provided on their website.

- Follow the prompts to speak with a representative who can assist you in requesting your Equifax report.

- Be prepared to provide the necessary identification and verification information as requested.

- The representative will guide you through the process and inform you of the next steps to receive your report.

- Mail-in Request:

- Write a formal letter to Equifax requesting your credit report.

- Include your full name, current address, social security number, and any other information requested by Equifax.

- Sign the letter and mail it to the designated address provided by Equifax.

- Allow sufficient time for processing and delivery, as mail-in requests may take longer than online or phone options.

- Equifax will send your credit report to the address you provided.

It’s important to note that when accessing your Equifax report, you may be required to verify your identity using security questions or other authentication methods. This is done to ensure the protection of your personal and credit information.

By utilizing one of these methods, individuals can easily open their Equifax report and gain valuable insights into their credit history, allowing them to make informed decisions and take appropriate steps towards credit repair and improvement.

In the following sections, we will explore the purpose of Equifax as a credit bureau, its current status, and the availability and cost of Equifax reports.

The Purpose of Equifax

Equifax serves a crucial purpose as one of the major credit bureaus operating in the United States. The primary function of Equifax, along with other credit bureaus, is to gather and maintain credit information on individuals and businesses. The purpose of Equifax can be summarized as follows:

- Credit Reporting: Equifax collects data from various sources, including lenders, creditors, and public records, to compile comprehensive credit reports. These reports contain valuable information about an individual’s credit history, including credit accounts, payment patterns, outstanding balances, and any derogatory marks such as late payments or collections. Creditors and lenders rely on Equifax reports to assess an individual’s creditworthiness when making lending decisions.

- Risk Assessment: Equifax uses the information in its reports to help assess the risk associated with extending credit to consumers. Lenders and creditors evaluate the data in Equifax reports to determine the likelihood of an individual repaying their debts on time. This risk assessment aids lenders in setting appropriate interest rates, credit limits, and terms for various financial products.

- Fraud Detection: Equifax plays a vital role in fraud detection and prevention. By monitoring credit activities and patterns, Equifax can help identify suspicious or potentially fraudulent activities. Any unauthorized accounts, suspicious inquiries, or identity theft incidents can be flagged in the Equifax report, alerting both consumers and lenders to take appropriate actions to mitigate the risk.

- Consumer Assistance: Equifax provides consumer assistance by offering tools, resources, and support to help individuals understand and manage their credit. Through educational materials, credit monitoring services, and dispute resolution processes, Equifax aims to empower consumers to take control of their credit and make informed financial decisions.

Is Equifax Still a Credit Bureau?

Yes, Equifax is still a prominent credit bureau. Alongside Experian and TransUnion, Equifax maintains its position as one of the three major credit reporting agencies in the United States. These bureaus are authorized by law to collect and maintain credit information and generate credit reports for consumers.

Equifax’s long-standing presence in the industry, coupled with its extensive data network and advanced analytical capabilities, continues to make it a vital player in the credit reporting ecosystem. It collaborates with thousands of lenders and creditors to gather credit data and ensure the accuracy and integrity of the information provided in its reports.

Are Equifax Reports Free?

Under federal law, individuals are entitled to one free credit report per year from each of the three major credit bureaus, including Equifax. This means that you can access your Equifax report at no cost once every 12 months. To obtain your free Equifax report, you can visit the official Annual Credit Report website (annualcreditreport.com), which is authorized by the government to provide these reports.

It’s important to note that while the Equifax report itself may be free, additional services such as credit monitoring or credit scores may incur fees. These optional services offer enhanced monitoring and analysis of credit data beyond the basic report.

In conclusion, Equifax serves the important purpose of gathering and maintaining credit information, facilitating risk assessment for lenders, assisting in fraud detection, and providing valuable consumer assistance. Equifax reports can be accessed for free once a year, allowing individuals to stay informed about their credit standing and take proactive steps towards credit repair and improvement.

Credit Repair Bay Area: Your Trusted Partner

When it comes to credit repair, Credit Repair Bay Area stands as a reliable and trusted partner for individuals seeking professional assistance. Unlike the big national companies filled with slick salesmen that often over-promise and under-deliver, Credit Repair Bay Area takes a different approach. As a local credit restoration agency, their primary focus is on delivering exceptional results and personalized service to their clients.

- Expertise and Experience: With over 19 years of experience in the industry, Credit Repair Bay Area has honed its expertise in credit repair strategies and techniques. Their team of professionals possesses in-depth knowledge of credit laws, regulations, and industry best practices. They stay updated on the latest trends and changes in the credit landscape, ensuring that their clients receive the most effective solutions.

- Customer-First Approach: At Credit Repair Bay Area, the client’s success and satisfaction take center stage. They understand that every individual’s credit situation is unique, requiring tailored solutions. By conducting a thorough analysis of each client’s Equifax report and credit history, they develop personalized strategies to address specific credit challenges. Their customer-first approach means that clients receive individual attention, transparent communication, and ongoing support throughout the credit repair process.

- Cutting-Edge Technology and Processes: Credit Repair Bay Area leverages the best cutting-edge technology, processes, and programs available in the industry. They utilize advanced software systems to analyze Equifax reports and identify inaccuracies, errors, or outdated information that may be negatively impacting credit scores. This technological advantage enables them to develop strategic plans and dispute inaccurate items on behalf of their clients with efficiency and precision.

- Building Trust and Long-Term Relationships: Trust is the cornerstone of Credit Repair Bay Area’s operations. They prioritize integrity, transparency, and open communication with their clients. By fostering trust and long-term relationships, they have earned a stellar reputation for delivering results and improving their clients’ credit profiles. Testimonials and success stories from satisfied clients serve as a testament to their dedication and the positive impact of their services.

In conclusion, Credit Repair Bay Area is your go-to credit restoration agency, offering expertise, personalized service, and a customer-first approach. With their years of experience, cutting-edge technology, and commitment to building trust, they provide the necessary guidance and solutions to help individuals overcome credit challenges. Whether it’s addressing inaccuracies on an Equifax report or implementing strategies for credit improvement, Credit Repair Bay Area is dedicated to helping clients achieve financial peace of mind and a brighter future.

Empowering Financial Well-Being

Credit Repair Bay Area not only focuses on repairing credit but also on empowering individuals to build a solid financial foundation for long-term success. Here’s how they go beyond credit repair to promote financial well-being:

- Financial Education: Credit Repair Bay Area believes that knowledge is power when it comes to managing personal finances. They provide valuable resources and educational materials to help clients understand credit, budgeting, saving, and responsible financial practices. By empowering individuals with financial literacy, they equip them with the tools needed to make informed decisions and maintain healthy financial habits.

- Personalized Guidance: Recognizing that each client’s financial situation is unique, Credit Repair Bay Area offers personalized guidance tailored to individual needs. They work closely with clients to develop customized action plans, setting achievable goals and milestones. Through one-on-one consultations and ongoing support, they provide the necessary guidance and encouragement for clients to navigate their credit journey and make positive financial choices.

- Long-Term Strategies: Credit Repair Bay Area takes a holistic approach to credit repair by focusing on long-term strategies. They help clients implement sustainable practices that lead to lasting improvements in credit scores and overall financial well-being. By establishing positive financial habits, such as responsible credit usage, timely bill payments, and smart budgeting, individuals can build a strong foundation for their financial future.

- Credit Building: Building credit is as important as repairing credit. Credit Repair Bay Area assists clients in understanding credit-building strategies and opportunities. They provide guidance on how to establish new lines of credit, diversify credit types, and manage credit responsibly. By taking proactive steps to build credit, individuals can strengthen their credit profiles and improve their borrowing options in the future.

In conclusion, Credit Repair Bay Area goes beyond credit repair by empowering individuals with the knowledge, guidance, and strategies needed to achieve financial well-being. By offering financial education, personalized guidance, long-term strategies, and credit-building assistance, they help clients take control of their finances and pave the way for a brighter financial future.

Remember, Credit Repair Bay Area’s passion for helping people fix their credit and their commitment to exceptional service make them a trusted partner on the journey towards financial success.

The Path to Financial Peace of Mind

Choosing Credit Repair Bay Area as your credit restoration agency sets you on the path to financial peace of mind. Here’s why partnering with them can make a significant difference in your credit journey:

- Results-Driven Approach: Credit Repair Bay Area is dedicated to delivering tangible results. Their proven strategies, combined with their expertise and experience, have helped numerous clients improve their credit scores and achieve their financial goals. By addressing inaccuracies, errors, and negative items on your Equifax report, they work diligently to restore your creditworthiness and open doors to better financial opportunities.

- Timely and Efficient Process: Time is of the essence when it comes to credit repair. Credit Repair Bay Area understands this and works efficiently to streamline the credit repair process. They leverage their cutting-edge technology and industry insights to navigate through the complexities of credit reporting, ensuring that your Equifax report is thoroughly reviewed and any necessary disputes are initiated promptly. This proactive approach saves you time and accelerates the credit repair timeline.

- Ongoing Support and Monitoring: Credit Repair Bay Area is committed to your long-term success. They provide continuous support and monitoring throughout your credit repair journey. Their team of professionals is readily available to answer your questions, address your concerns, and provide updates on the progress of your credit repair. With their guidance and expertise, you can stay informed and confident in the steps being taken to improve your credit standing.

- Financial Freedom and Opportunities: Repairing your credit with Credit Repair Bay Area opens doors to financial freedom and opportunities. As your credit improves, you gain access to better interest rates, favorable loan terms, and increased borrowing power. This can make a significant difference in your ability to secure loans, mortgages, credit cards, and rental agreements. By repairing and building your credit, you create a solid foundation for a brighter financial future.

In conclusion, Credit Repair Bay Area is your trusted partner on the path to financial peace of mind. With their results-driven approach, efficient processes, ongoing support, and focus on unlocking financial opportunities, they empower you to take control of your credit and build a strong financial foundation. By choosing Credit Repair Bay Area, you are one step closer to achieving the financial well-being and peace of mind you deserve.

Remember, Credit Repair Bay Area’s passion for helping individuals like you fix and build their credit sets them apart as a local agency committed to exceptional service and client satisfaction.

Trust Credit Repair Bay Area for Your Credit Restoration Needs

When it comes to repairing your credit and achieving financial stability, Credit Repair Bay Area is the name you can trust. Here are the key reasons why you should choose Credit Repair Bay Area for your credit restoration needs:

- Proven Track Record: Credit Repair Bay Area boasts a strong track record of success in helping individuals restore their credit. Over their 19 years of operation, they have assisted numerous clients in improving their credit scores and achieving their financial goals. Their satisfied clients and positive testimonials speak to their expertise, professionalism, and commitment to delivering exceptional results.

- Personalized Approach: Credit Repair Bay Area understands that each individual’s credit situation is unique. They take a personalized approach to credit restoration, tailoring their strategies and solutions to address your specific needs. By conducting a thorough analysis of your Equifax report and credit history, they develop a customized action plan that is designed to maximize the effectiveness of their services for your specific circumstances.

- Transparent and Honest: Honesty and transparency are fundamental values at Credit Repair Bay Area. They believe in providing clear and straightforward information to their clients throughout the credit restoration process. You can trust them to explain the details of their services, fees, and expected timelines in a transparent manner. They prioritize open communication and ensure that you are well-informed and confident about the steps being taken to repair your credit.

- Compliance with Industry Standards: Credit Repair Bay Area adheres to the highest industry standards and regulations. They are well-versed in the laws governing credit repair, including the Fair Credit Reporting Act (FCRA). By following ethical practices and guidelines, they ensure that their credit restoration services are conducted in a lawful and responsible manner.

- Exceptional Customer Service: At Credit Repair Bay Area, exceptional customer service is at the core of their operations. They genuinely care about their clients’ well-being and go the extra mile to provide outstanding service. Their dedicated team of professionals is readily available to answer your questions, address any concerns, and provide support throughout the credit restoration journey. They prioritize your satisfaction and work diligently to exceed your expectations.

In conclusion, Credit Repair Bay Area is the trusted partner you need for credit restoration. With their proven track record, personalized approach, transparency, compliance with industry standards, and exceptional customer service, they are committed to helping you achieve the credit scores and financial stability you desire. Trust Credit Repair Bay Area to guide you on your journey to a brighter financial future.

Remember, Credit Repair Bay Area’s passion for helping people fix their credit, their dedication to delivering results, and their customer-first focus make them the credit restoration agency you can rely on.