Can You Get a Credit Card without Credit?

Building credit is essential for various financial endeavors, such as obtaining loans, renting apartments, or even applying for certain jobs. However, if you have no credit history, you might wonder if it’s possible to get a credit card. Fortunately, there are options available that can help you establish credit from scratch, and one such option is a secured credit card.

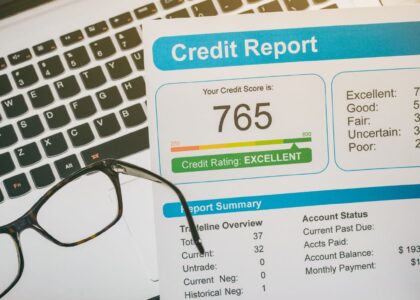

- Understanding the Role of Credit Cards in Building Credit Credit cards play a vital role in building and establishing credit history. They provide an opportunity to demonstrate responsible credit behavior, such as making timely payments and maintaining low credit utilization. Lenders and credit bureaus use this information to assess your creditworthiness and calculate your credit score.

- Explaining Secured Credit Cards as an Option for Individuals with No Credit Secured credit cards are specifically designed for individuals with limited or no credit history. Unlike traditional credit cards, secured cards require a cash deposit as collateral, which serves as your credit line. The deposit acts as security for the lender in case you default on payments.

- Benefits and Considerations of Secured Credit Cards Secured credit cards offer several benefits for those looking to build credit:

- Accessibility: Secured cards are often more accessible for individuals with no credit or poor credit, as the deposit mitigates the risk for the lender.

- Building Credit: By using a secured card responsibly, you can demonstrate your ability to manage credit and establish a positive credit history.

- Gradual Credit Limit Increase: Some secured card issuers review your account periodically and may increase your credit limit over time based on your payment history and creditworthiness.

- Transition to Unsecured Cards: With responsible use and positive credit history, you may be eligible to upgrade to an unsecured credit card in the future.

However, it’s important to consider the following factors:

- Deposit Requirements: Secured cards require an initial deposit, typically ranging from a few hundred to several thousand dollars, depending on the card issuer and your desired credit limit.

- Annual Fees and Interest Rates: Some secured cards may have annual fees and higher interest rates compared to traditional credit cards. It’s essential to compare offers and understand the associated costs.

- Credit Reporting: Ensure that the secured card reports to major credit bureaus. This ensures that your responsible credit behavior is reflected in your credit report and helps build your credit history.

- Tips for Choosing the Right Secured Credit Card When selecting a secured credit card, consider the following tips:

- Research Different Card Offers: Compare various secured credit card options to find one with favorable terms, low fees, and reasonable interest rates.

- Check Credit Reporting Practices: Confirm that the card issuer reports to all three major credit bureaus (Equifax, Experian, and TransUnion) to maximize the impact on your credit history.

- Graduation Opportunities: Inquire about the possibility of transitioning to an unsecured credit card after demonstrating responsible credit management.

- Responsible Usage: Make timely payments, keep credit utilization low, and avoid carrying a balance to maximize the positive impact on your credit.

By utilizing a secured credit card responsibly, you can establish a credit history and work towards building a solid credit foundation. Remember, credit repair agencies like Credit Repair Bay Area can provide guidance and expertise to help you navigate the credit-building process effectively.

Establishing Credit with No Credit Score

Having no credit score can make it challenging to access credit opportunities, but there are alternative methods available to help you establish credit from scratch. In this section, we will explore some strategies and options that can assist you in building credit when you have no credit history.

- Becoming an Authorized User on Someone Else’s Credit Card One option to consider is becoming an authorized user on a family member’s or a close friend’s credit card. By being added as an authorized user, the primary cardholder’s credit history and positive payment behavior can potentially be reflected on your credit report. It’s important to ensure that the primary cardholder has a good credit history and pays their bills on time. While this method can help establish a credit history, it’s crucial to have an open and honest conversation with the primary cardholder regarding expectations and responsibilities.

- Applying for a Credit Builder Loan Credit builder loans are specifically designed to help individuals build credit. These loans typically work by depositing the loan amount into a locked savings account or certificate of deposit (CD). You make monthly payments toward the loan, and once the loan term is complete, you receive the funds along with a positive payment history reported to the credit bureaus. Credit builder loans provide an opportunity to establish a credit history while simultaneously saving money.

- Exploring Credit-Building Programs and Services Various financial institutions and organizations offer credit-building programs and services. These programs typically involve opening a savings or checking account and enrolling in a credit-building program. With these programs, you make regular payments into the account, and the institution reports your payment history to the credit bureaus. Over time, consistent payments can help establish a positive credit history.

- Secured Loans and Credit Cards In addition to secured credit cards, you can also explore secured loans as a means to build credit. Similar to secured credit cards, secured loans require collateral, such as a deposit or a savings account balance. Making timely payments on a secured loan can demonstrate your ability to manage credit responsibly and help establish a positive credit history.

It’s important to note that building credit takes time and patience. During this process, it’s crucial to practice responsible credit habits, such as making payments on time, keeping credit utilization low, and managing debt wisely. Regularly monitoring your credit report for accuracy and addressing any errors or discrepancies is also essential.

Opening an Account with No Credit Score

Having no credit score may present challenges when trying to open a bank account, but there are options available for individuals in this situation. In this section, we will explore the possibilities and provide guidance on how to open an account when you have no credit score.

- Research Different Account Options Start by researching different types of bank accounts that are accessible to individuals with no credit score. Most financial institutions offer basic checking or savings accounts specifically designed for individuals who are new to banking or have no credit history. These accounts often have fewer requirements and lower fees compared to more advanced account options.

- Choose the Right Financial Institution Select a financial institution that is known for being friendly toward individuals with limited or no credit history. Look for banks or credit unions that have a history of working with individuals in similar situations and have positive customer reviews. Local community banks or credit unions may be more accommodating and understanding of your circumstances compared to larger national banks.

- Gather Required Documentation When opening a bank account, you will typically need to provide certain documentation to verify your identity and address. This may include:

- Valid identification, such as a passport, driver’s license, or state ID

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Proof of address, such as a utility bill, lease agreement, or bank statement

- Consider Joint or Co-Signer Accounts If you are having difficulty opening an account on your own, consider exploring the option of a joint account or obtaining a co-signer. A joint account allows you to open an account with someone else, such as a family member or close friend, who has an established credit history. Alternatively, a co-signer is someone who agrees to take responsibility for the account if you are unable to fulfill your obligations. Having a joint account or a co-signer can increase your chances of being approved for an account, as their credit history can provide additional support.

- Build a Relationship with the Financial Institution Once you have successfully opened an account, focus on building a positive relationship with the financial institution. This includes making regular deposits, avoiding overdrafts or bounced checks, and demonstrating responsible account management. Building a solid banking relationship can contribute to establishing trust and may lead to more favorable opportunities in the future, such as qualifying for additional banking services or loans.

The Expert Knowledge of Credit Repair Bay Area

When it comes to credit repair, having expert knowledge and guidance can make a significant difference in achieving your credit goals. Credit Repair Bay Area, an established credit restoration agency with over 19 years of experience, offers a wealth of expertise and a customer-first approach to assist individuals in their credit repair journey. In this section, we will explore the advantages of working with Credit Repair Bay Area and how their services can benefit you.

- Extensive Experience in Credit Repair Credit Repair Bay Area’s 19 years of experience in the credit repair industry speaks to their knowledge and expertise. Throughout their years of operation, they have encountered a wide range of credit situations and have successfully helped clients navigate through the complexities of credit repair. Their experience allows them to understand the nuances of credit reporting, credit scoring models, and the best strategies for addressing inaccuracies and negative items on credit reports.

- Customized Strategies for Individual Needs Credit Repair Bay Area recognizes that each individual’s credit situation is unique. They take a personalized approach to develop customized strategies that align with your specific needs and goals. Their team of professionals conducts a thorough analysis of your credit reports, identifies inaccuracies, and formulates tailored action plans to address them effectively. By focusing on individualized solutions, they maximize the chances of success in improving your credit.

- Cutting-Edge Technology and Resources Credit Repair Bay Area stays at the forefront of the industry by utilizing cutting-edge technology and resources. They leverage advanced tools and software to streamline the credit repair process, making it more efficient and effective. By staying up-to-date with the latest industry developments and trends, they can employ the most effective strategies and techniques to deliver optimal results for their clients.

- Expertise in Dealing with Credit Bureaus Interacting with credit bureaus can be complex and time-consuming. Credit Repair Bay Area has extensive experience in communicating and negotiating with credit bureaus on behalf of their clients. They understand the processes and protocols involved and can effectively advocate for accurate and fair reporting of your credit information. Their expertise in dealing with credit bureaus ensures that your rights as a consumer are protected throughout the credit repair process.

- Commitment to Customer Satisfaction Credit Repair Bay Area’s customer-first focus sets them apart from larger national companies. As a local credit restoration agency, they prioritize the satisfaction and well-being of their clients. Their goal is not only to improve your credit but also to empower you with the knowledge and tools to build a strong and healthy credit profile in the long term. They value open communication, transparency, and a supportive approach in helping you achieve the financial peace of mind you deserve.

The Benefits of Choosing a Local Credit Repair Agency

When it comes to credit repair, choosing a local agency like Credit Repair Bay Area over big national companies can offer numerous advantages. In this section, we will explore the benefits of working with a small local credit repair agency and why their personalized approach can make a significant difference in your credit repair journey.

- Personalized Attention and Customer Care Local credit repair agencies prioritize personalized attention and customer care. Unlike larger national companies that may treat clients as numbers, Credit Repair Bay Area focuses on building relationships with their clients. They take the time to understand your unique credit situation, listen to your concerns, and develop tailored strategies to address your specific needs. Their commitment to personalized service ensures that you receive the attention and support you deserve throughout the credit repair process.

- In-Depth Knowledge of Local Credit Landscape Local credit repair agencies have a deep understanding of the local credit landscape and dynamics. They are familiar with the specific challenges and opportunities that individuals in your area may face when it comes to credit repair. This localized knowledge allows them to provide targeted guidance and advice that aligns with the specific credit reporting practices and regulations in your region. Their expertise in the local credit landscape can be invaluable in navigating the complexities of credit repair effectively.

- Focus on Community and Referral Networks Being part of the local community, credit repair agencies like Credit Repair Bay Area often have established referral networks and relationships with other local professionals, such as mortgage brokers, real estate agents, and lenders. These connections can provide additional resources and support to help you achieve your financial goals beyond just credit repair. They can refer you to trusted professionals who can assist with mortgage applications, loan approvals, and other financial services that may be integral to your credit journey.

- Flexible and Accessible Communication Channels Working with a local credit repair agency means you can often enjoy more flexible and accessible communication channels. You can meet face-to-face with their team, have in-depth discussions about your credit goals, and receive personalized advice in person. This level of direct interaction fosters transparency and trust throughout the credit repair process. Local agencies also tend to have shorter response times and offer greater availability for phone calls and consultations.

- Support for Local Economy and Small Businesses Choosing a local credit repair agency contributes to supporting the local economy and small businesses in your area. By investing in a local agency, you help stimulate economic growth, create job opportunities, and foster a thriving community. Your partnership with a local agency demonstrates your commitment to supporting local businesses and contributing to the overall well-being of your community.

Achieving Financial Peace of Mind

Credit Repair Bay Area understands that the ultimate goal of credit repair is to achieve financial peace of mind. In this section, we will explore how their services and approach can help you not only improve your credit but also build a solid financial foundation for a brighter future.

- Improved Credit Score and Creditworthiness One of the primary benefits of working with Credit Repair Bay Area is the potential for an improved credit score and enhanced creditworthiness. Their expertise in identifying and addressing inaccuracies, erroneous negative items, and outdated information on your credit report can lead to significant improvements in your credit score. A higher credit score opens doors to better financial opportunities, including favorable interest rates, increased chances of loan approvals, and access to premium credit products.

- Enhanced Financial Stability Credit Repair Bay Area’s personalized strategies and guidance are aimed at helping you achieve long-term financial stability. By addressing negative items, improving your credit utilization, and practicing responsible financial habits, you can establish a solid foundation for your financial well-being. Their team will work with you to develop effective budgeting and debt management strategies, empowering you to take control of your finances and achieve stability.

- Knowledge and Education Beyond credit repair, Credit Repair Bay Area places a strong emphasis on empowering their clients with knowledge and education. They provide resources, tips, and guidance on credit management, budgeting, and smart financial practices. By arming you with the necessary knowledge, they enable you to make informed decisions and develop healthy financial habits that will benefit you for years to come.

- Long-Term Relationship and Ongoing Support Credit Repair Bay Area is committed to building long-term relationships with their clients. They understand that credit repair is not a one-time process, and they are dedicated to providing ongoing support even after your initial credit repair goals have been achieved. Whether you have questions, need guidance on credit-building strategies, or require assistance with future financial endeavors, they will be there to support you every step of the way.

- Peace of Mind and Financial Confidence Ultimately, Credit Repair Bay Area’s mission is to provide you with peace of mind and financial confidence. By helping you address inaccuracies and improve your credit, they remove the stress and uncertainty that often accompany credit issues. With their guidance and expertise, you can regain control over your financial future and have the confidence to pursue your goals, whether it’s homeownership, starting a business, or achieving other milestones.

Taking the First Step towards Credit Repair

Now that you have learned about Credit Repair Bay Area and the benefits they offer, it’s time to take the first step towards credit repair. In this section, we will outline the process of getting started and how Credit Repair Bay Area can assist you on your credit repair journey.

- Initial Consultation The first step is to schedule an initial consultation with Credit Repair Bay Area. During this consultation, their team of experts will listen to your credit concerns, goals, and financial aspirations. They will conduct a thorough review of your credit reports and provide an assessment of your current credit situation. This consultation is an opportunity to ask questions, understand the credit repair process, and gain clarity on how Credit Repair Bay Area can assist you.

- Credit Analysis and Action Plan Following the initial consultation, Credit Repair Bay Area will conduct a comprehensive credit analysis. They will review your credit reports from all three major credit bureaus – Equifax, Experian, and TransUnion – to identify inaccuracies, errors, and negative items that may be impacting your credit score. Based on their findings, they will develop a customized action plan tailored to your specific credit repair needs. This plan will outline the steps they will take to address inaccuracies, dispute negative items, and work towards improving your credit.

- Credit Repair Process Credit Repair Bay Area will act on your behalf to dispute inaccuracies and negative items with the credit bureaus and relevant creditors. They will leverage their expertise, industry knowledge, and established relationships with credit bureaus to facilitate the resolution of disputes. Throughout the credit repair process, they will keep you informed of progress, provide updates on the status of your disputes, and answer any questions you may have. Their goal is to achieve the best possible outcomes for your credit repair efforts.

- Ongoing Support and Monitoring Credit Repair Bay Area provides ongoing support and monitoring throughout the credit repair process. They will keep track of your progress, monitor your credit reports for any changes, and provide guidance on maintaining good credit habits. Their team is always available to address your concerns, provide updates, and offer advice on credit-building strategies. With their support, you can stay on track towards achieving your credit goals.

- Building a Strong Credit Foundation In addition to credit repair, Credit Repair Bay Area will work with you to build a strong credit foundation for the future. They will provide guidance on managing your credit responsibly, establishing positive credit history, and improving your credit utilization. By implementing their recommendations and adopting healthy financial habits, you can maintain and further improve your credit over time.

Conclusion: Taking the first step towards credit repair involves scheduling an initial consultation with Credit Repair Bay Area. From there, their team will conduct a credit analysis, develop a customized action plan, and guide you through the credit repair process. With their ongoing support, expertise, and commitment to your success, you can build a strong credit foundation and achieve your financial goals. Don’t hesitate to reach out to Credit Repair Bay Area and take control of your credit future today.