Your credit scores and credit reports are two factors that assist prospective lenders determine if you have a good chance of making your payments on time whether you apply for a credit card, apartment rental, mortgage, or vehicle loan.

Your credit reports provide thorough details on how you’ve used credit in the past. The result of such computation is a credit score, which is just a single number that measures your creditworthiness.

Consider reports to be similar to a medical record, which includes information such as symptoms and test findings, with scores serving as the final diagnosis. Financial items may only be accessed with good credit ratings. Let’s analyze it:

CREDIT SCORE

Lenders use your credit score as a number to determine whether you are a dangerous or safe customer. The FICO score, which is available in a variety of variations and many of them are specialized scores for items like credit cards or auto loans, is the one that is most frequently used to determine credit choices. VantageScore, a rival to FICO, is also considered when making loan choices.

Your credit reports contain the data that is used to calculate all credit ratings. When controlling your credit score, the following are the most important aspects:

- Your repayment history, including any negative marks for late or missed payments.

- The credit usage ratio measures how much of your credit limit you are currently using.

- the quantity of “hard inquiries,” or recent credit applications, that you have made.

- How old your credit is, or how long you’ve had credit accounts.

- Your available credit options (the kind with fixed payments, like an auto loan, or variable payments, like a credit card).

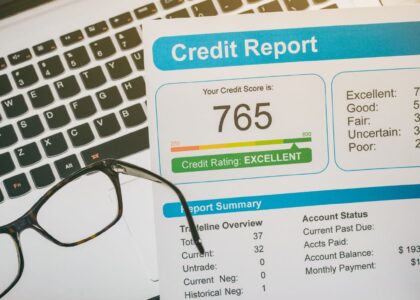

Depending on your account activity, your scores will vary. The range of VantageScore and the majority of FICO models is 300 to 850. Scores of 690 or above are regarded as “good,” while those of 720 or higher are regarded as “outstanding.” The two scoring models take into account the same variables, so if you do well on one, you probably will do well on the other.

The lender will look at your credit score to establish your eligibility when you apply for a credit card or loan. It’s a good idea to keep an eye on your score yourself so you can get a sense of how a lender could see you. This might be particularly helpful if you want to improve your credit.

Just always use the same score in the same version. It’s similar to how you weigh yourself; using the same scale each time eliminates little variances caused by the equipment.

CREDIT REPORT

Your credit reports provide a thorough summary of your credit lines and payment history, but they are missing your credit score. The reports are compiled by Equifax, Experian, and TransUnion, three of the largest credit bureaus.

As they describe your accounts and how rigorously you’ve paid off outstanding obligations, credit reports can include too many pages. Your credit report will also contain negative data, such as repossessions or bankruptcies.

You most likely don’t have credit reports yet if you’ve never had credit accounts. Because credit reports may be used to assess applicants’ eligibility for loans, credit cards, rents, insurance policies, and employment, establishing a credit history is crucial.

Reports can contain inaccuracies, so it’s crucial to thoroughly review them and raise any issues you uncover with the organization that produced the report. Online dispute resolution is the quickest method, but you can also contact us by phone or letter. Each of the three credit reporting agencies is required to provide free credit reports to everyone. Customers can use AnnualCreditReport.com for free weekly access through the end of 2022.